Crypto Swap Fees – A Practical Guide

When working with crypto swap fees, the charges applied each time you exchange one cryptocurrency for another on a platform. Also known as swap fees, they directly affect how much profit you keep from each trade. Understanding crypto swap fees is the first step to avoiding surprise costs.

Why Decentralized Exchanges Matter

Most traders encounter swap fees on decentralized exchanges, peer‑to‑peer platforms that run on blockchain smart contracts. Also called DEXs, they set fee rates based on on‑chain parameters rather than a central authority. This means the fee model you see on Uniswap, PancakeSwap, or a Klaytn DEX can differ dramatically from a centralized venue.

Another key player is the liquidity provider, an address or smart contract that supplies token pairs to facilitate swaps. Liquidity providers earn a slice of the swap fee, so the more depth they contribute, the lower the fee for traders. In practice, a deep pool on a DEX often translates to a 0.25% fee, while a shallow pool can push rates upward.

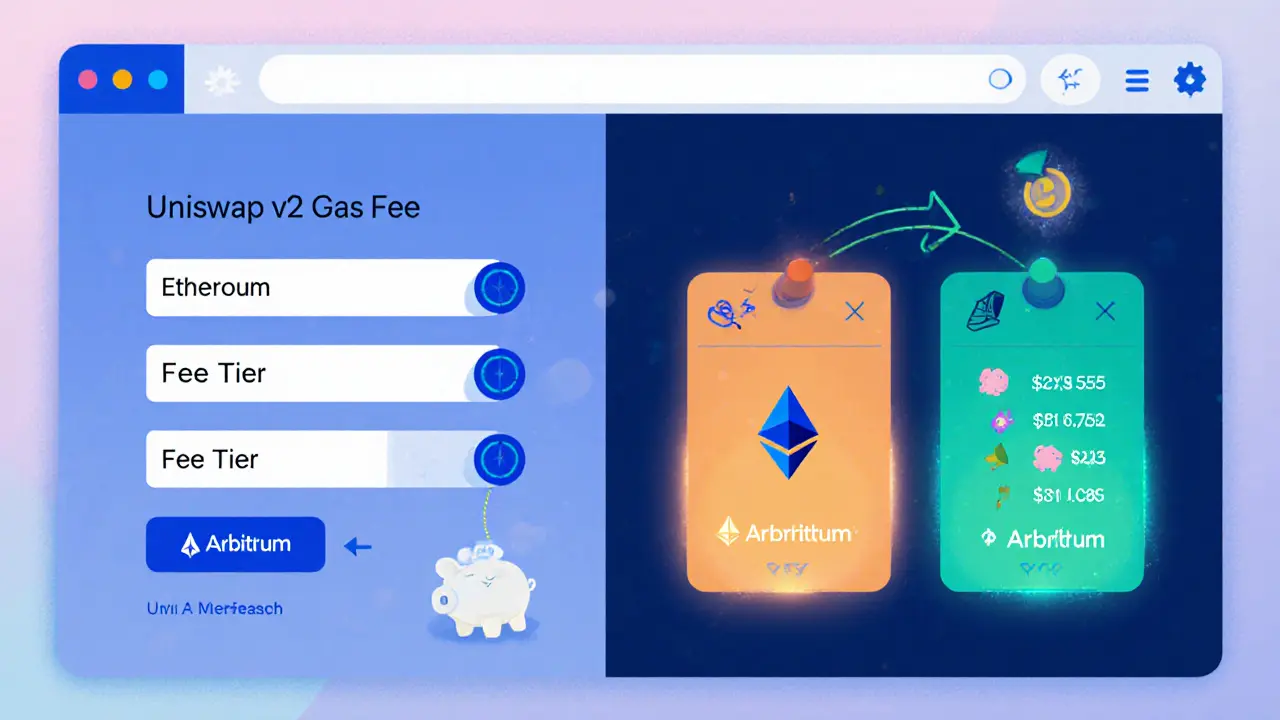

Every swap also carries a transaction fee, the amount of gas you pay to record the trade on the blockchain. This fee is separate from the swap fee itself but can dominate the total cost on high‑traffic networks like Ethereum. When gas prices surge, a seemingly tiny 0.3% swap fee may feel expensive compared to the underlying transaction fee.

The actual token swap, the process of converting one crypto asset into another, often follows either a fixed‑rate or a dynamic‑rate model. Fixed‑rate swaps lock the price and fee at the moment you start the trade, offering predictability. Dynamic‑rate swaps adjust in real time based on pool size and market volatility, which can lead to lower fees during calm periods but higher fees when liquidity thins.

Putting these pieces together, crypto swap fees encompass transaction fees, are influenced by liquidity provider structures, and are shaped by the rules of each decentralized exchange. Below you’ll find reviews of popular DEXs, breakdowns of fee formulas, and tips on minimizing costs across different platforms. Dive in to see how each factor plays out in real‑world trading scenarios.

A 2025 review of Uniswap v2 on Arbitrum covering fees, liquidity, security, user experience, and how it stacks up against v3.

Categories

Archives

Recent-posts

What is CZodiac Farming Token (CZF) crypto coin? The truth behind a nearly worthless token

Nov, 11 2025

Finance

Finance