Crypto Security: Protecting Your Digital Assets

When talking about crypto security, the practice of safeguarding digital assets, networks, and transaction flows against theft, fraud, and cyber‑attacks. Also known as digital asset security, it forms the backbone of any trustworthy crypto ecosystem. Blockchain, a decentralized ledger that records transactions in immutable blocks provides the structural layer that makes tampering extremely hard. Cryptographic protocols, algorithms like SHA‑256 and elliptic‑curve signatures that verify data integrity and authenticate users are the technical tools that lock and unlock value. Finally, exchange security, the set of measures an exchange uses to protect user funds and personal data is the front‑line defense many traders rely on daily. Mastering crypto security means understanding how these pieces fit together.

Why does crypto security matter now more than ever? Recent regulatory moves show how law and technology intersect. China’s 2025 ban on all crypto activity tightened enforcement, pushing users toward privacy‑focused solutions. In India, a 30% tax on crypto profits forces traders to keep impeccable records or face steep penalties. Those examples illustrate a semantic triple: Regulatory compliance influences crypto security. At the same time, crypto security requires robust cryptographic protocols to meet the standards set by regulators and protect against hacks. And because most attacks target exchanges, crypto security encompasses exchange security, meaning any weak spot on a platform can jeopardize an entire portfolio. Understanding these relationships helps you stay ahead of both legal changes and technical threats.

Practical tools and real‑world checks bring the theory to life. Our reviews of OpenSwap, SuperEx, Coinext, and other platforms dive deep into security features like two‑factor authentication, cold‑wallet storage, and smart‑contract audits. We also break down how Merkle trees create tamper‑proof proofs for transaction histories—an essential concept for anyone verifying blockchain data. When it comes to airdrops, knowing the token’s smart‑contract source and checking for phishing traps can save you from lost funds. Even energy‑focused projects, such as blockchain‑enabled power management in Pakistan, illustrate how secure protocols can enable large‑scale mining without compromising the grid. All these pieces—exchange reviews, cryptographic fundamentals, and compliance guides—show how crypto security is a multi‑layered discipline.

What You’ll Discover Below

The articles that follow cover everything from the latest regulatory updates in China, India, Taiwan, and Bolivia to hands‑on guides for claiming airdrops safely. You’ll find security‑focused exchange reviews, deep dives into cryptographic tools like Merkle trees, and practical advice on staying compliant with tax laws worldwide. Whether you’re a seasoned trader, a developer building DeFi apps, or just curious about how to protect your crypto holdings, this collection gives you the context and actionable steps you need. Let’s explore the landscape together.

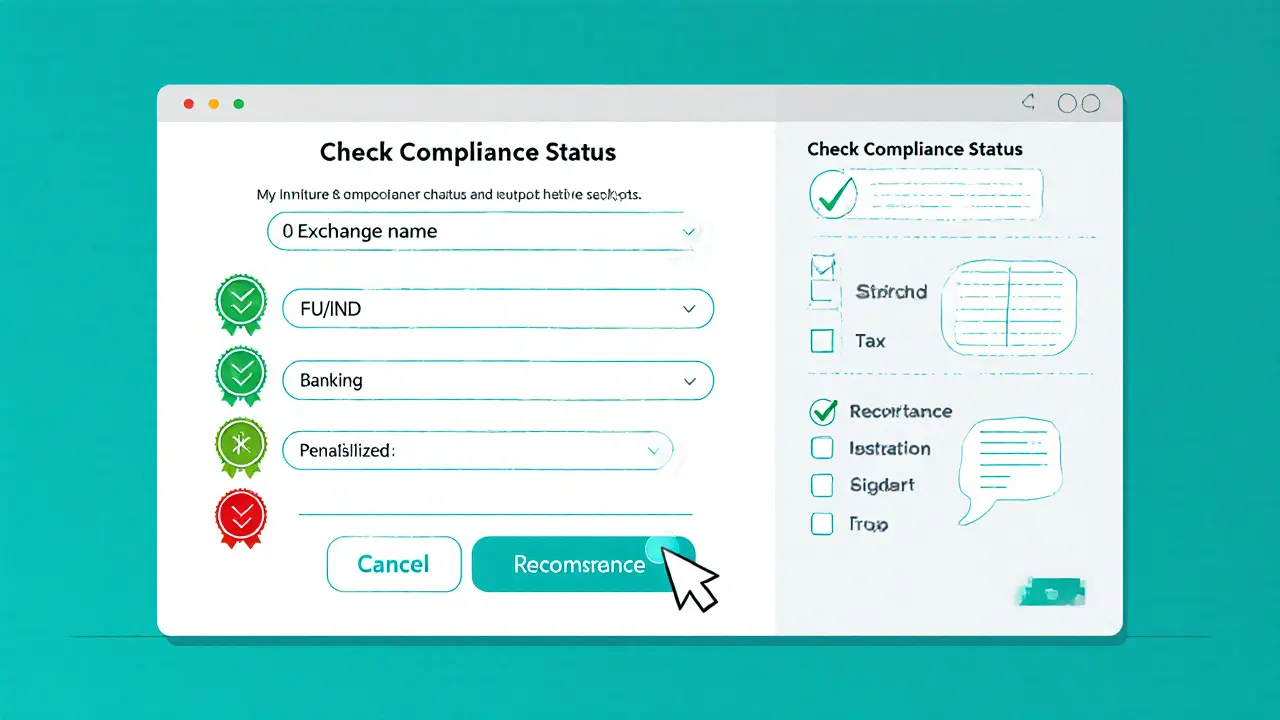

Learn which crypto exchanges Indian traders should avoid in 2025, why compliance matters, and how to pick safe platforms with practical checks and a handy checklist.

Finance

Finance