Crypto Airdrop Guide: Spot Real Giveaways and Dodge Scams

When dealing with crypto airdrop, a free token distribution meant to boost awareness and reward early supporters. Also known as airdrop, it can be a powerful way to get into a project without spending cash. Below you’ll also see references to POTS airdrop, the token giveaway linked to Moonpot on Binance Smart Chain, AST Unifarm airdrop, the distribution from the Unifarm protocol, SupremeX airdrop, a DeFi lending token giveaway run via Bitget and VERSE airdrop, the promotional token tied to CoinMarketCap’s VerseWar game. Understanding how each fits into the broader airdrop ecosystem helps you separate the wheat from the chaff.

Why do projects bother with airdrops? The short answer: hype and network effects. Giving away tokens for free can spark community growth, generate buzz on social media, and provide early liquidity. In 2023, over $300 million worth of tokens were handed out across dozens of chains. That sheer volume means you’ll see a mix of serious launches and meme‑coin gimmicks. Knowing the goal behind a giveaway—whether it’s to reward genuine users or just to pump price—sets the stage for the rest of your evaluation.

Eligibility is the first checkpoint. Legit airdrops usually require you to hold a specific token, complete a KYC step, or perform a simple on‑chain action like staking or bridging. Anything that asks for private keys, upfront fees, or obscure wallet types should raise a red flag. Most reputable projects publish a clear criterion list on their official site or a verified Telegram channel. Keep a spreadsheet of required actions, deadlines, and the exact wallet address you’ll receive the tokens on.

Scams thrive on the promise of free money. Common tricks include phishing links that mimic the project’s domain, fake countdown timers, and impersonated influencers. A quick Google search of the project’s name plus “scam” often surfaces warning threads on Reddit or Bitcointalk. Also watch out for airdrops that promise unrealistic returns—if the token’s market cap would have to jump thousands of percent just to be worthwhile, you’re probably looking at hype, not value.

Regulatory landscapes shape airdrop safety, too. Countries like China have banned all crypto giveaways, while India imposes a 30 % tax on any earned tokens. Knowing the jurisdiction of the project’s team can hint at how rigorously they’ll follow compliance. Projects that openly address tax implications and provide guidance for users in high‑liability regions tend to be more trustworthy.

Key Elements of a Safe Airdrop

A solid airdrop checklist includes four pillars: verification, transparency, community engagement, and post‑distribution support. Verification means the token contract is audited and the source code is public. Transparency covers a clear roadmap, an accessible team profile, and a legitimate tokenomics model. Community engagement shows up as active Discord or Telegram chats where moderators answer questions promptly. Finally, post‑distribution support includes tutorials on claiming, how to add the token to popular wallets, and a plan for future token utility.

Let’s see how the marked examples stack up. The POTS airdrop required users to hold at least 100 MOT on Binance Smart Chain and provided a step‑by‑step claim guide on the Moonpot blog—good transparency, but the token’s utility remains vague. The AST Unifarm airdrop offered rewards to liquidity providers on the Unifarm platform; its contract was audited, and the team posted a detailed FAQ, scoring high on verification. The SupremeX airdrop was tied to a Bitget staking event, with clear KYC requirements and a published tokenomics sheet, making it one of the more compliant giveaways. The VERSE airdrop leveraged a game mechanic (VerseWar) to distribute tokens; while fun, the reward schedule was complex, and the project’s legal status in several jurisdictions is still unclear.

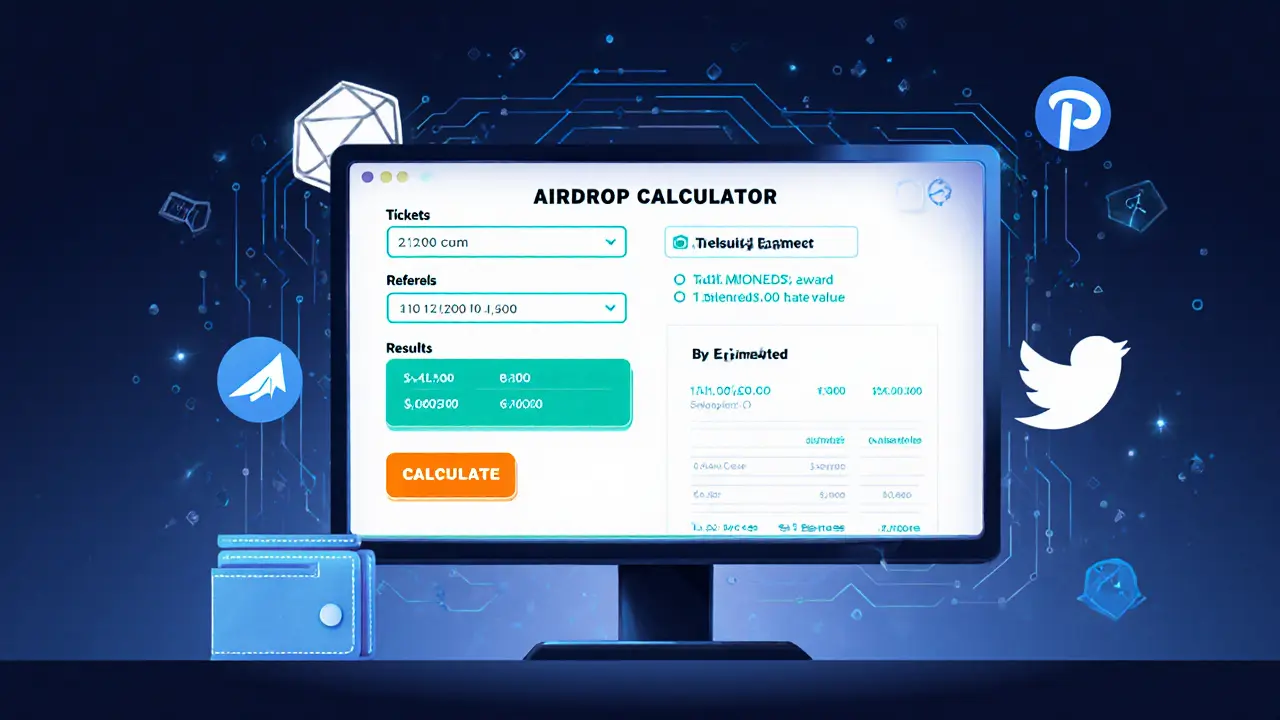

Armed with this framework, you can build your own quick assessment sheet. List the project’s name, required holdings, verification steps, audit status, and any red‑flag notes. If three or more items raise concerns, skip it. If the project checks most boxes, dive deeper—watch the launch, monitor price evolution, and decide whether to hold or sell based on the roadmap.

Now that you’ve got a clear picture of what makes a crypto airdrop trustworthy, you’re ready to explore our curated collection below. Each article breaks down a specific giveaway, highlights eligibility, warns about potential scams, and gives actionable steps to claim safely. Dive in and start collecting real value without the headache of fraud.

Learn how to claim the SHO token airdrop by Showcase, including eligibility, step‑by‑step instructions, timeline, safety tips, and a handy FAQ.

Learn how to claim the Bull Finance airdrop in 2025, eligibility rules, step‑by‑step guide, tokenomics, safety tips and FAQs for the BULL token.

Learn how to claim Swaperry's PERRY token airdrop, eligibility criteria, timelines, and risks. A step‑by‑step guide for the 2025 IDO promotion.

Learn how the MoonEdge (MOONED) airdrop worked, claim amounts, current price, where to trade, and what’s next for the multi‑chain launchpad.

Categories

Archives

Recent-posts

What is Children Of The Sky (COTS) crypto coin? Real risks, no game, and why it's fading fast

Jan, 31 2026

Finance

Finance