Buying Bitcoin, staking Ethereum, or trading altcoins isn’t just about market moves-it’s about taxes. And those taxes vary wildly depending on where you live. In one country, you might pay nothing. In another, you could lose more than half your profit. If you’re holding crypto across borders or thinking of relocating, this isn’t just a footnote-it’s a make-or-break factor.

Where Crypto Is Taxed the Most

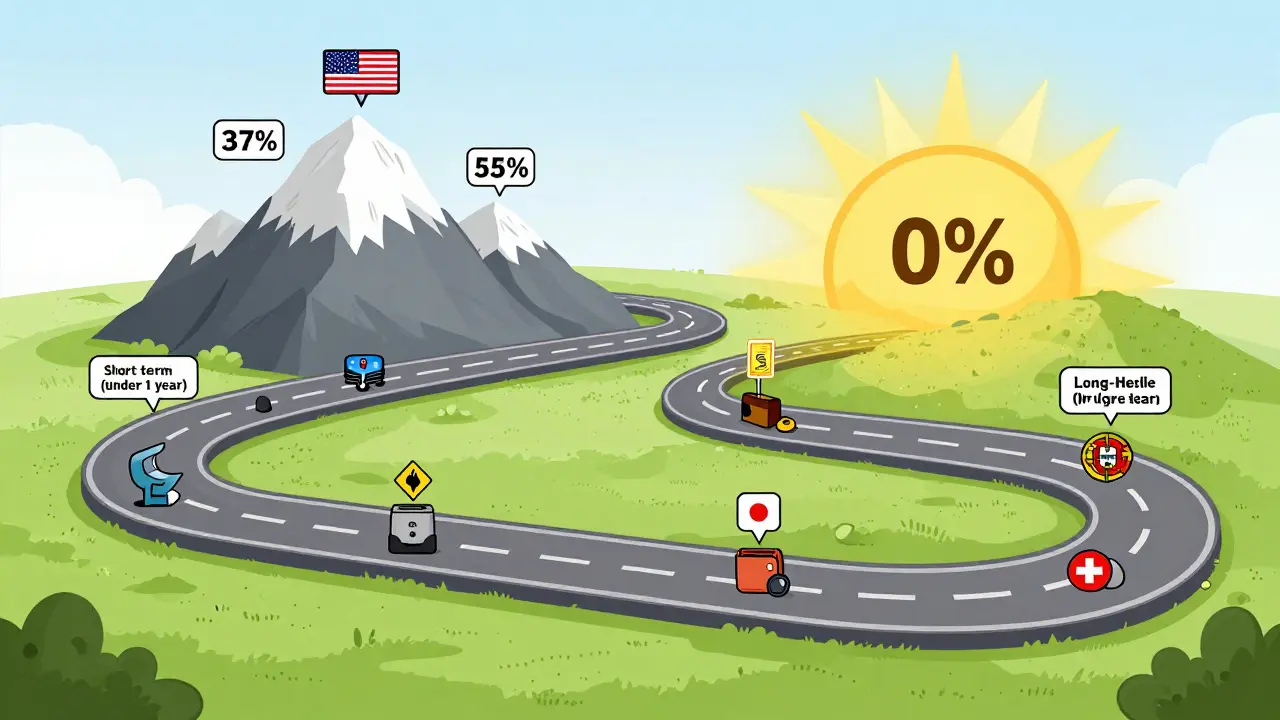

Japan leads the pack with the highest possible crypto tax rate: 55%. That’s not a flat rate-it’s the top end of a progressive income tax system. If you’re a high earner and sell crypto you held for less than a year, you’re looking at the same rate as your salary. Denmark isn’t far behind, with rates between 37% and 52%, depending on your income bracket. Both countries treat crypto gains as ordinary income, not capital gains, which means no special breaks for holding longer.

France has a flat 30% tax on crypto-to-fiat sales, but that’s not the whole story. Staking rewards, mining income, and airdrops? Those get taxed as regular income-up to 45%. And if you forget to report a single wallet? You could face fines up to €750 per unreported account. The French tax office doesn’t just rely on self-reporting-they actively audit crypto users and cross-check data with exchanges.

Germany’s system is more nuanced. If you sell crypto after holding it for over a year, you pay 0%. But if you sell within 12 months? You’re hit with progressive income tax rates up to 45%. That’s not a loophole-it’s a deliberate incentive. The government wants you to hold, not trade. And yes, you still have to report every transaction to the Federal Central Tax Office, even if you owe nothing.

Where Crypto Is Taxed the Least

Twelve countries have zero tax on crypto transactions as of 2025. That includes El Salvador, where Bitcoin is legal tender-so you can’t avoid it even if you wanted to. But the real draw for investors? Places like the United Arab Emirates, Switzerland, and Hong Kong. In the UAE, whether you’re holding for a day or five years, you pay 0%. Same in Switzerland-for private investors, crypto gains are completely tax-free. No reporting needed. No forms. No penalties.

Portugal is a special case. They charge 28% on short-term gains, but if you hold for over a year? Tax-free. But here’s the catch: you need to be a tax resident, meaning you live there at least 183 days a year. Non-residents? No tax at all. That’s why so many crypto nomads set up base in Lisbon or Porto.

Malaysia and Hong Kong take a different approach. They don’t tax personal crypto investments at all. But if you’re trading like a business-buying and selling daily, running a mining operation, or running a crypto fund? Then you’re taxed as a business. That’s a smart system: it doesn’t punish casual holders, but it still collects from active traders.

How the UK Handles Crypto Taxes

In the UK, crypto is treated as property-not currency. That means capital gains tax applies when you sell, trade, or spend it. For 2025, your tax-free allowance is £3,000. Anything above that? Basic-rate taxpayers pay 10%. Higher-rate taxpayers? 20%. It sounds simple, but the trap is in the details.

Every swap counts. Trade ETH for SOL? Taxable event. Use BTC to buy a laptop? Taxable event. Even gifting crypto to a friend triggers a capital gain. You have to track the cost basis of every coin you bought, every trade you made, and every time you spent it. The HMRC doesn’t just look at exchange statements-they can request wallet addresses and blockchain data. Miss a transaction? Fines can hit 200% of the tax you avoided.

And don’t forget income tax. If you earn crypto through staking, mining, or as a salary (like a Web3 job), that’s taxed as income. So if you make £50,000 in salary and earn £10,000 in staking rewards, you’re taxed on £60,000 total.

What the US Does Differently

The U.S. separates crypto gains into short-term and long-term. If you hold less than a year? Taxed as ordinary income-rates from 10% to 37%. If you hold over a year? Long-term capital gains rates apply: 0%, 15%, or 20%, depending on your income. That’s a massive incentive to wait.

But here’s where it gets messy: every airdrop, every staking reward, every mining payout? That’s taxed as income on the day you receive it. So if you get 1 ETH as a reward and it’s worth $3,000 that day, you owe income tax on $3,000-even if you never sell it. Later, if you sell it for $4,000, you owe capital gains on the $1,000 profit.

The IRS doesn’t just trust your word. They’ve been demanding data from Coinbase, Kraken, and other exchanges since 2016. If your name shows up on a 1099 form, they know. And if you didn’t report it? You’re on the hook for back taxes, penalties, and interest.

Why Holding Periods Matter

It’s not just about where you live-it’s about how long you hold. In Germany, Switzerland, and Portugal, holding past one year wipes out your tax bill. In the U.S., it cuts your rate by up to 80%. Even in the UK, where there’s no long-term discount, holding longer means you can spread gains across multiple tax years using your £3,000 allowance.

That’s why smart investors time their sales. Sell £2,000 in December, another £1,000 in January. That way, you stay under the allowance and pay nothing. It’s legal. It’s strategic. And it’s something most beginners don’t even think about.

What About Mining and Staking?

These aren’t just passive income-they’re taxable events. In the U.S., France, and the UK, you pay income tax on the value of the crypto when you receive it. In Germany, mining is taxed as business income. In Malaysia, if you’re mining at scale, you’re taxed as a business. If you’re just staking a few coins for fun? Often exempt.

But here’s the kicker: you have to track the exact USD value of each reward at the moment you receive it. If you get 0.05 BTC on January 5th when it’s worth $3,000, that’s your cost basis. Later, if you sell it for $3,500, you owe capital gains on $500. But if you don’t record that $3,000 value? You’re guessing your tax bill-and the tax office isn’t guessing with you.

Compliance Is Getting Harder

Five years ago, you could fly under the radar. Now, tax agencies have blockchain analytics tools. They can trace transactions across wallets. They can match exchange data with your tax return. The UK, France, and the U.S. are already doing this. Even countries without formal crypto tax laws are starting to monitor.

And the penalties? They’re not jokes. In France, undeclared accounts can cost you €750 each. In the UK, you can be fined 200% of the tax you didn’t pay. In the U.S., intentional non-reporting can lead to criminal charges.

It’s not about fear. It’s about accuracy. If you’re holding crypto across multiple wallets or exchanges, you need a system. Use a tax tool like Koinly or CoinTracker. Record every transaction. Know your cost basis. Don’t rely on exchange summaries-they don’t track cross-wallet transfers or gifts.

Who Should Consider Relocating?

If you’re a serious crypto investor with significant gains, where you live matters more than you think. Moving to the UAE or Switzerland could save you tens of thousands in taxes. But it’s not just about tax rates-it’s about residency rules, banking access, and legal clarity.

Portugal’s 183-day rule is strict. The UAE requires you to prove you’re not a tax resident elsewhere. Switzerland doesn’t tax private investors, but if you’re running a crypto business? You’re taxed. And El Salvador? You can’t avoid Bitcoin, but you also can’t easily open a bank account as a foreigner.

Don’t move just for taxes. But if you’re already planning to relocate, make crypto tax a top factor. The difference between paying 20% and 0% isn’t just money-it’s compounding growth over time.

What’s Next?

More countries will follow the EU’s lead and tighten reporting. The U.S. might lower long-term rates. Japan could introduce a holding period exemption. But one thing’s clear: the era of tax-free crypto is ending everywhere except a handful of jurisdictions.

The winners? Those who plan ahead. Track everything. Understand your local rules. Use the holding periods to your advantage. And if you’re unsure? Get professional advice. Crypto tax isn’t DIY anymore-it’s too complex, too risky, and too expensive to guess.

Is crypto taxed in the UK?

Yes. The UK taxes crypto as property. You pay capital gains tax at 10% or 20% on profits above £3,000 (2025 allowance). Staking, mining, and airdrops are taxed as income. Every trade, spend, or gift counts as a taxable event. You must report all activity on a Self-Assessment Tax Return.

Which countries have 0% crypto tax?

As of 2025, the following countries charge no tax on personal crypto transactions: Brunei, Cyprus, El Salvador, Georgia, Germany (for holdings over 1 year), Hong Kong, Malaysia, Oman, Panama, Saudi Arabia, Switzerland, and the United Arab Emirates. Each has different residency or activity rules-some only apply to private investors, not businesses.

Do I pay tax if I trade crypto for crypto?

Yes, in most countries. Trading ETH for SOL is treated as selling ETH and buying SOL. You owe capital gains tax on the profit from ETH. The only exceptions are countries like Malaysia and Hong Kong, where personal crypto trades aren’t taxed-but only if you’re not running a business.

What happens if I don’t report my crypto gains?

You risk fines, audits, and in some cases, criminal charges. The UK can charge up to 200% of unpaid tax. France fines €750 per unreported wallet. The IRS can pursue criminal penalties for tax evasion. With blockchain tracking and exchange reporting, hiding crypto gains is no longer realistic.

How do I track my crypto taxes?

Use a crypto tax tool like Koinly, CoinTracker, or CryptoTaxCalculator. Import your wallet addresses and exchange data. These tools calculate cost basis, gains, and generate tax reports. Never rely on exchange statements alone-they don’t track cross-wallet transfers or gifts. Manual tracking is possible but error-prone for active traders.

Is staking crypto taxable?

Yes. In the U.S., UK, France, and most countries, staking rewards are taxed as income at their fair market value when received. Later, if you sell them, you pay capital gains on any increase in value. Germany and Portugal treat staking as income, not capital gain. Always record the USD value on the day you receive each reward.

Finance

Finance

Julene Soria Marqués

January 22, 2026 AT 18:14Ugh, I just sold some ETH last week and got hit with like 30% in taxes. Why does the US make this so complicated? I just wanted to buy a coffee with crypto, not file a novel.

Also, why do I have to track every single swap? I’m not a CPA.

Also also, why is the IRS acting like we’re all tax evaders? I’m not hiding anything, I just want to live my life.

Abdulahi Oluwasegun Fagbayi

January 24, 2026 AT 11:58Taxing crypto like income is like taxing air. If you don’t consume it, why charge for it?

But in Nigeria, we don’t even have a system to track this. So we just hold and hope the government doesn’t notice.

Maybe that’s the real tax haven.

Andy Marsland

January 26, 2026 AT 06:34People don’t realize how fundamentally broken the U.S. crypto tax framework is. The IRS treats every micro-transaction as a capital gain, which violates the very principle of fungibility. You’re essentially being taxed on the *perception* of value change, not actual economic activity. This is economic absurdity wrapped in bureaucratic legalese. And don’t even get me started on how staking rewards are taxed at receipt-this is double taxation disguised as income. You’re paying income tax on something that hasn’t been liquidated, then capital gains on the same asset later? That’s not tax policy, that’s extortion dressed in a spreadsheet.

And yes, I’ve audited 12 crypto tax software platforms. None of them handle cross-chain swaps correctly. You’re all just guessing.

Mathew Finch

January 26, 2026 AT 11:47Switzerland? UAE? Please. You think those places are crypto utopias? They’re tax havens for rich Americans running from their own government. Meanwhile, real people in America are paying 20% on their gains while billionaires hide behind shell companies in the Caymans. You call that fairness? I call it class warfare-and the IRS is on the side of the 1%.

Shamari Harrison

January 28, 2026 AT 01:50If you’re new to crypto taxes, start with Koinly. Import your wallets, let it do the math, then double-check the big trades manually. Don’t wait until April. I’ve seen too many people panic because they didn’t track gifts or cross-wallet transfers.

Also, remember: if you’re not a business, you’re probably fine under the £3k or $0 allowances. Just keep receipts.

You got this.

Nadia Silva

January 29, 2026 AT 16:59Canada doesn’t tax crypto gains? That’s not true. We tax it as capital gains, 50% of the gain is taxable. But we do have a $1,000 annual exemption for personal use. Still, the system is better than the U.S. mess. At least we don’t treat every swap like a crime.

Roshmi Chatterjee

January 31, 2026 AT 01:22I’m in India and we just introduced 30% tax on crypto with no deductions. But here’s the thing-I still made more than I would’ve in a 9-to-5. So I pay it gladly. It’s not about avoiding tax, it’s about building wealth. And if the government wants a slice? Fine. But I want them to stop treating us like criminals.

Also, staking rewards? I track every one. No excuses.

Deepu Verma

January 31, 2026 AT 18:42Don’t stress. If you’re holding for over a year, you’re already ahead of 90% of people. Use your allowance. Spread your sales. Don’t try to be smart-be consistent.

And if you’re unsure? Talk to a pro. A one-hour consultation could save you thousands. This isn’t gambling-it’s planning.

MICHELLE REICHARD

February 2, 2026 AT 17:40Germany’s 1-year rule? Cute. But only if you’re a German citizen. If you’re a foreigner? Good luck proving residency. And don’t even think about using a German wallet to avoid taxes-your bank will report you. This whole post is just crypto bro propaganda. Real investors don’t move for tax breaks. They move for freedom. And freedom doesn’t come with a tax code.

Jen Allanson

February 3, 2026 AT 05:23It is imperative to underscore that the Internal Revenue Service has unequivocally classified cryptocurrency as property, and therefore, all transactions involving the disposition of such property must be reported in accordance with Section 1001 of the Internal Revenue Code. Failure to comply constitutes a material breach of fiduciary duty and may result in civil and criminal liability. I implore all readers to consult a licensed tax attorney prior to engaging in any crypto activity.

Clark Dilworth

February 3, 2026 AT 06:36Most people don’t realize that the real tax advantage isn’t in the jurisdiction-it’s in the structure. If you’re holding crypto across borders, you need a DAO LLC in Wyoming, a Swiss private foundation, and a non-resident bank account. That’s how the top 0.1% do it. The rest of you are just playing with your wallets and hoping the IRS doesn’t ping you.