SecondBTC Security: How to Keep Your Tokens Safe

When working with SecondBTC security the set of security measures, audits, and compliance tools built around the SecondBTC cryptocurrency SecondBTC protection, you’re looking at more than just a fancy buzzword. It’s a concrete framework that mixes smart‑contract reviews, real‑time monitoring, and regulatory checks to stop hacks before they happen. Think of it as the guard dog that watches every transaction, code change, and market move for the SecondBTC ecosystem.

One of the biggest allies in this effort is cryptocurrency security the practice of safeguarding digital assets through encryption, multi‑factor authentication, and continuous vulnerability scanning. Without solid crypto security, even the best audit can’t stop a phishing attack or a compromised private key. That’s why SecondBTC security always starts with a strong base: hardware wallets, cold storage, and strict access controls. From there, a thorough blockchain audit—your next key player—steps in to verify that the code behaves exactly as intended.

Why Audits, Compliance, and Real‑World Risks Matter

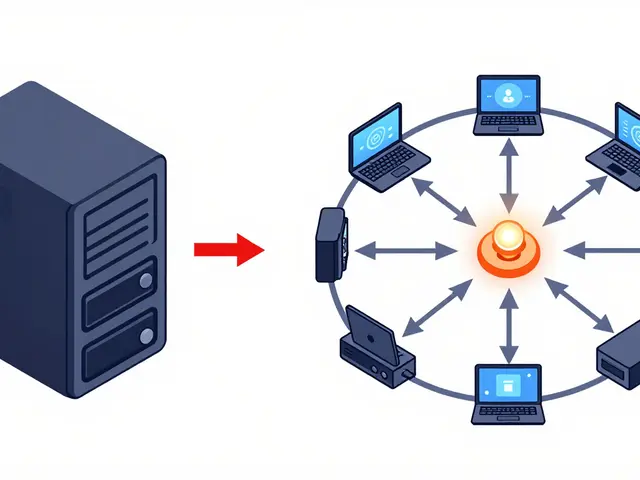

A blockchain audit is more than a checklist. It’s a deep dive into the token’s smart contracts, transaction flows, and governance rules. When auditors find a flaw, they don’t just note it; they propose fixes, retest, and often run formal verification to prove the bug is truly gone. This process directly influences token trust and market confidence, forming a clear semantic triple: SecondBTC security encompasses blockchain audit. In practice, this means every new feature or upgrade to SecondBTC must pass a security review before it goes live.

But security doesn’t stop at code. crypto exchange compliance the set of rules and procedures exchanges follow to meet AML, KYC, and local regulatory standards shapes how SecondBTC can be listed, traded, and moved across platforms. An exchange that skips compliance opens a backdoor for money‑laundering and fraud, which in turn drags the token’s reputation down. Therefore, SecondBTC security requires exchange compliance to keep both users and regulators happy.

Real‑world examples from our article collection illustrate these points. The “India’s 30% Crypto Tax Explained” guide shows how tax rules can affect user behavior, while the “China Crypto Regulation 2025” piece highlights the impact of strict government policies on token movement. Both underscore why a holistic security approach—covering code, exchanges, and legal landscapes—is essential for any token, especially SecondBTC.

Another piece of the puzzle is token airdrop safety. When a project launches an airdrop, like the “Bull Finance Airdrop Details” post, scammers often impersonate official channels to steal wallets. Integrating airdrop verification into SecondBTC security helps users spot fake URLs, bogus claims, and phishing attempts before they click. In short, a well‑rounded security strategy links cryptocurrency security, blockchain audit, and exchange compliance into a single defensive wall.

Putting all these elements together, you get a clear picture of how SecondBTC security works in practice. It starts with strong foundational crypto security, adds rigorous audits to verify the code, layers exchange compliance to meet legal standards, and finishes with user‑focused safeguards like airdrop checks. This layered approach creates several semantic triples: SecondBTC security includes cryptocurrency security; SecondBTC security requires blockchain audit; SecondBTC security relies on exchange compliance. Each connection reinforces the others, making the overall system far tougher to breach.

Below you’ll find a curated list of articles that dive deeper into each of these areas—tax rules, exchange reviews, audit techniques, and airdrop safety—so you can see how the concepts work together in real scenarios. Whether you’re a trader, developer, or just curious about protecting your crypto, these pieces will give you actionable insights to strengthen your own SecondBTC holdings.

A thorough 2025 review of SecondBTC crypto exchange covering fees, coin list, security, liquidity, and how it stacks up against Binance and Coinbase.

Finance

Finance