Indian Crypto Regulations

When working with Indian crypto regulations, the legal framework that controls digital asset activity in India, covering tax, licensing, and compliance. Also known as India cryptocurrency law, it shapes how traders, investors, and businesses operate in the country. Indian crypto regulations have become a daily topic for anyone holding or swapping coins because they directly affect profit margins and platform choices.

One major piece of the puzzle is crypto tax, the 30% tax on crypto gains plus a 1% TDS on transactions introduced by the Finance Ministry. This tax framework forces every trader to calculate net earnings before every sell, and it pushes firms to adopt robust record‑keeping tools. The tax rule doesn’t stand alone; it interacts with reporting obligations from the Income Tax Department, meaning mistakes can lead to heavy penalties.

Another cornerstone is the Reserve Bank of India (RBI), the central bank that issues guidelines on crypto trading, stablecoins, and the use of digital payments infrastructure. The RBI’s stance influences everything from which exchanges can access banking services to how stablecoin issuers must hold collateral. When the RBI signals tighter scrutiny, exchanges scramble to adjust KYC processes, and investors often see sudden shifts in liquidity.

Alongside the RBI, the Securities and Exchange Board of India (SEBI), the regulator that oversees securities markets and is beginning to draft rules for crypto derivatives and tokenized assets plays an expanding role. SEBI’s upcoming guidelines could unlock new product types, but they also add another compliance layer for platforms that want to list tokenized securities. Understanding SEBI’s future direction helps traders anticipate where new investment opportunities might appear.

Key Elements of India’s Crypto Framework

Indian crypto regulations encompass three intersecting areas: tax policy, central bank oversight, and securities regulation. The tax policy sets the cost of trading, the RBI shapes the banking and payments landscape, and SEBI determines how tokenized securities can be offered. Together they form a web that traders must navigate to stay compliant and profitable.

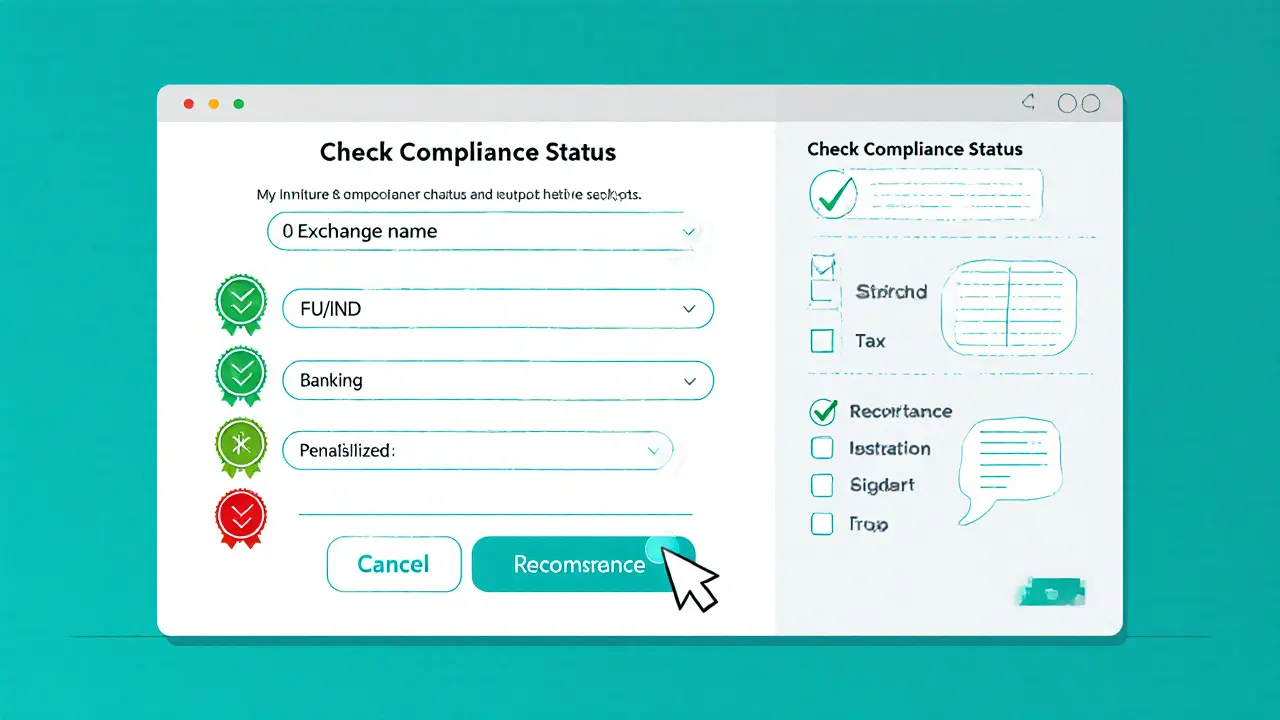

Compliance isn’t just about filing forms. It requires technical steps like integrating KYC/AML APIs that satisfy both RBI and SEBI standards, using accounting software that can auto‑calculate the 30% tax and generate TDS certificates, and choosing exchanges that have secured banking partnerships. Platforms that ignore any of these pieces risk losing access to Indian users or facing fines.

For newcomers, the biggest hurdle is often the tax calculation. The 30% flat rate applies to net gains, while short‑term trades are taxed as regular income. Additionally, the 1% TDS is deducted at source on every sale above a certain threshold, meaning the amount you receive is already reduced. Smart traders set up spreadsheets or use crypto tax tools that pull transaction data from exchanges and automatically apply the correct rates.

Exchange licensing is another hot spot. The RBI’s recent guidelines require crypto exchanges to maintain a minimum net‑worth, hold a certain percentage of assets in Indian rupees, and obtain a specific banking correspondent. Failure to meet these criteria can lead to account freezes or loss of fiat on‑ramps. As a result, many global exchanges have opened dedicated Indian subsidiaries or partnered with local fintech firms.

Stablecoins have attracted particular attention. The RBI classifies most stablecoins as “virtual assets” that need to be backed by reserves held with regulated entities. Projects aiming to launch an Indian‑rupee stablecoin must register with the RBI, disclose reserve audits, and adhere to anti‑money‑laundering protocols. This creates both a barrier for new issuers and a reassurance for users who want a dollar‑linked asset without leaving India.

SEBI’s draft rules suggest that tokenized real estate, bonds, and even equities could become tradable on blockchain platforms. If approved, this would open a new market for investors seeking fractional ownership. However, the draft also mandates that token issuers obtain a registration certificate and follow strict disclosure norms, mirroring traditional securities regulation.

All these pieces—tax, RBI, SEBI—feed into each other. For example, a higher tax rate can discourage high‑frequency trading, which in turn reduces the transaction volume that banks see, possibly prompting the RBI to tighten liquidity rules. Likewise, SEBI’s entry into tokenized assets could push the RBI to clarify how such tokens fit within its stablecoin framework. Understanding these feedback loops helps you anticipate policy shifts before they happen.

Practical steps for anyone dealing with Indian crypto regulations include: 1) Register on an exchange that has RBI‑approved banking partners; 2) Use a tax calculator that supports the 30% flat rate and automatically generates TDS proof; 3) Keep records of every trade for at least six years, as required by the Income Tax Department; 4) Monitor RBI circulars and SEBI draft releases for changes that could affect your portfolio; 5) If you plan to issue or hold stablecoins, verify the reserve backing and the registrar’s compliance status.

Staying ahead of the regulatory curve isn’t optional—it’s the difference between earning steady returns and facing unexpected fines. Below you’ll find a curated set of articles that break down each component in detail, from tax calculations and exchange reviews to deeper dives into RBI and SEBI policies. Dive in to get the actionable insights you need to trade confidently under India’s evolving crypto landscape.

Learn which crypto exchanges Indian traders should avoid in 2025, why compliance matters, and how to pick safe platforms with practical checks and a handy checklist.

Finance

Finance