Crypto Tax Germany: What You Need to Know

When dealing with Crypto Tax Germany, the set of rules that govern how German residents must report and pay taxes on cryptocurrency transactions. Also known as German crypto tax, it affects anyone who buys, sells, or farms digital assets.

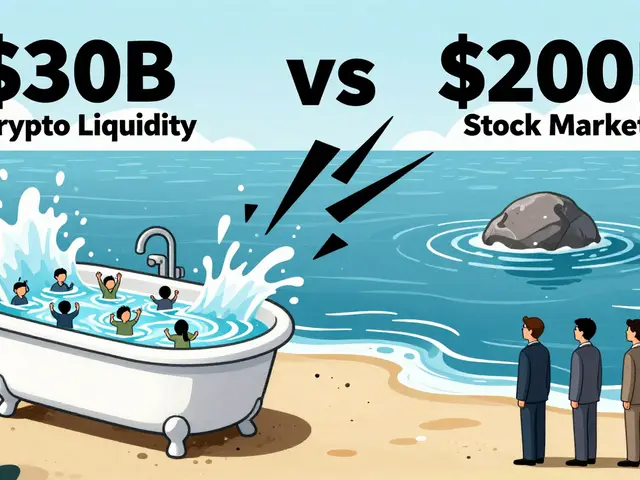

In Germany, profits from crypto are treated under Capital Gains Tax, tax on profits from selling crypto assets. If you hold a token for more than a year, the gain can be tax‑free; shorter holding periods trigger regular income tax rates. This makes the holding period a critical factor for every trader.

The tax office you’ll interact with is the Finanzamt, Germany’s federal tax authority responsible for collecting and enforcing taxes. They require a clear record of each transaction, including purchase price, sale price, and the date of acquisition. Missing or inaccurate info can lead to audits and penalties, so accurate bookkeeping is non‑negotiable.

Tools and Practices That Make Compliance Easy

Most German crypto users rely on Tax Reporting Software, digital tools that import exchange data, calculate taxable events, and generate the required tax forms. Programs like CoinTracking, Koinly, and local solutions such as Cryptotax DE automate the heavy lifting and help you stay within the law without drowning in spreadsheets.

Beyond software, it’s worth understanding the broader tax landscape. Germany distinguishes between private‑asset transactions (Privatvermögen) and commercial activity. If you’re mining, staking, or running a DeFi business, the income may be classified as Gewerbe (business income), which brings additional obligations like trade tax and mandatory VAT registration. Knowing where your activity falls saves you from surprise tax bills.

Another piece of the puzzle is the annual tax declaration (Einkommensteuererklärung). You’ll need to fill out the Anlage KAP (capital gains) section for crypto profits and possibly Anlage SO for other income types. The deadline is usually July 31 of the following year, unless you use a tax advisor, which can extend it to the end of February.

Finally, keep an eye on the evolving legal framework. The German government periodically updates its guidance, especially as the EU’s MiCA regulation rolls out. Staying informed through reliable newsletters or the official Bundesfinanzministerium releases ensures you won’t be caught off‑guard by new reporting thresholds or documentation requirements.

With these basics covered, you’re ready to explore the detailed articles below. They dive into edge cases, step‑by‑step software tutorials, and real‑world examples that will help you apply the rules to your own portfolio.

Learn how Germany's 1‑year holding rule makes long‑term crypto gains tax‑free, see short‑term rates, compliance steps, and useful tools for investors in 2025.

Categories

Archives

Recent-posts

BiKing Crypto Exchange Review: Risks, Security Issues, and Why It’s Not for Most Traders

Nov, 28 2025

Finance

Finance