Crypto Licensing: Rules, Compliance, and How It Impacts Your Projects

When navigating crypto licensing, the set of legal permissions, permits, and compliance frameworks that let cryptocurrency projects and exchanges operate within a jurisdiction, you quickly realize it ties together several moving parts. Crypto licensing isn’t just a single permit; it’s a collection of authorizations that include utility token regulation, rules governing tokens that provide access to a platform’s services rather than a profit‑share, the EU’s MiCA, the Markets in Crypto‑Assets framework that standardises licensing across European member states, and the national virtual asset service provider (VASP) registration, which ensures exchanges, wallet providers and custodians meet anti‑money‑laundering (AML) standards. In practice, exchange compliance, the ongoing obligation of crypto platforms to adhere to licensing terms, reporting duties and consumer‑protection rules sits on top of these foundations.

This web of rules creates a few clear relationships: crypto licensing encompasses utility token regulation; MiCA influences crypto licensing in the European market; VASP registration supports exchange compliance; and each of these entities requires a formal application, ongoing audits, and transparent reporting. For a startup launching a new token, the first step is to map which of these entities apply: does the token qualify as a utility? Is the project targeting EU users, triggering MiCA? Will you operate an exchange, demanding a VASP license? Answering those questions early saves months of re‑work and costly fines.

Regulators worldwide are tightening the net, and the cost of non‑compliance is steep. In China, a blanket ban means any crypto activity is illegal, while in Bolivia a new licensing regime sparked a 500% surge in digital‑asset activity after the ban was lifted. The United States treats token offerings under the Howey test, and Europe is rolling out MiCA over the next two years. These shifts all funnel back into the core idea of crypto licensing: you need a clear legal footing before you can market, trade, or fundraise.

From a practical standpoint, crypto licensing impacts three core areas of a project’s life cycle. First, fundraising – a licensed token can list on regulated exchanges, attract institutional capital, and avoid the “unregistered securities” label. Second, operations – VASP‑registered exchanges must implement KYC/AML tools, maintain transaction logs, and undergo periodic audits, which in turn affect user onboarding and liquidity. Third, risk management – a well‑documented licensing strategy provides a defense against regulatory enforcement, protects investors, and often lowers insurance premiums for custodial services.

If you’re a developer, the licensing checklist usually starts with a jurisdiction analysis, followed by token classification, then the actual application process for the relevant license (crypto‑exchange, VASP, or utility‑token specific). Documents typically include a whitepaper, AML/CTF policies, technical security audits, and a proof of capital. Many jurisdictions also demand a resident director or physical office, turning licensing into a hybrid legal‑business exercise.

Our collection of articles below touches every facet of this ecosystem. You’ll find deep dives into India’s 30% crypto tax, China’s full ban, utility‑token compliance under MiCA, and step‑by‑step guides to claim airdrops that often require a VASP‑approved wallet. Together they form a practical toolkit: whether you’re evaluating a new exchange, planning an airdrop, or figuring out how a stablecoin fits into your compliance roadmap, the insights here will help you align your project with the right crypto licensing framework.

Ready to explore the specifics? Scroll down to see how regulators shape token design, what the latest licensing trends mean for exchanges, and actionable steps you can take today to keep your crypto venture on the right side of the law.Why Understanding Crypto Licensing Matters Right Now

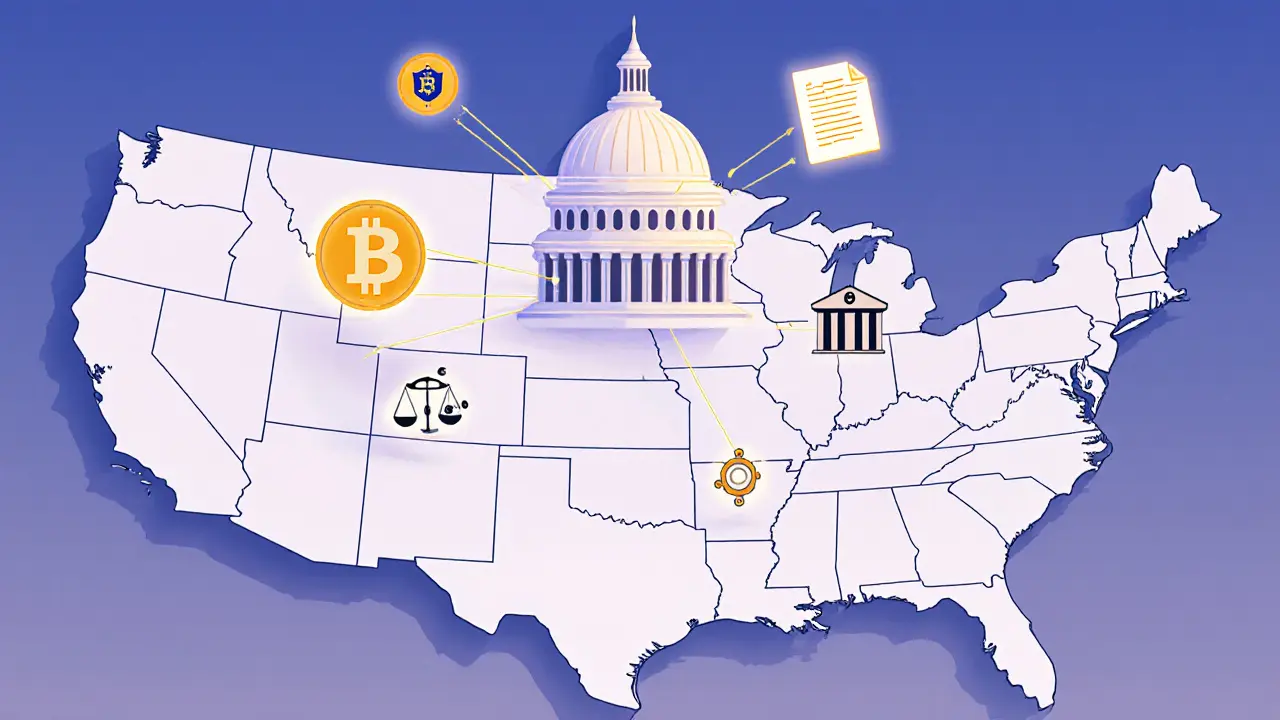

A 2025 guide that breaks down US crypto regulation state by state, covering federal laws, New York's BitLicense, California's DFPI, other key states, compliance steps, and future outlook.

Finance

Finance