Non-Resident Indian Crypto: Insights and Updates

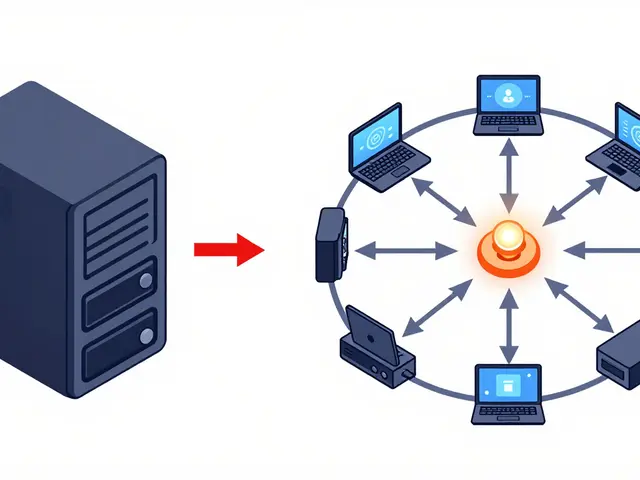

When you hear Non‑Resident Indian Crypto, the practice of Indian citizens living abroad buying, holding, or trading digital assets. Also known as NRI crypto activity, it intertwines cross‑border finance, local tax rules, and global market trends. This niche sits at the crossroads of three core ideas: India Crypto Tax, the 30% levy on crypto gains that applies to residents and NRIs alike, Crypto Regulations in India, the evolving legal framework that shapes what digital assets can be traded and how, and the choice of Crypto Exchanges for NRIs, platforms that meet Indian compliance while offering global liquidity. In short, non‑resident Indian crypto encompasses cross‑border trading, requires solid knowledge of India Crypto Tax, and is heavily influenced by Crypto Regulations in India. Understanding these connections lets you dodge compliance penalties and pick the right exchange for your strategy.

Why Tax and Exchange Choices Matter for NRIs

The 30% India crypto tax isn’t just a number—it changes how NRIs calculate profit, report to the Indian tax authority, and claim foreign tax credits. For example, if you earn $10,000 from Bitcoin while living in Singapore, you’ll owe $3,000 to India unless a double‑taxation treaty reduces the burden. Accurate record‑keeping, TDS compliance, and GST considerations become daily chores for NRI traders. At the same time, not every exchange meets the Financial Intelligence Unit (FIU) standards. Platforms flagged in the “Indian Crypto Exchanges to Avoid in 2025” list often lack robust KYC, expose users to AML fines, and may freeze assets without notice. Choosing a FIU‑compliant exchange not only safeguards your funds but also simplifies tax filing, because many of these platforms generate pre‑filled tax reports that align with Indian regulations. By pairing a tax‑aware mindset with a vetted exchange, you cut the risk of surprise penalties and keep your portfolio growing.

Beyond taxes and exchanges, global events ripple into the NRI crypto space. China’s 2025 crypto ban, Taiwan’s selective banking restrictions, and Bolivia’s rapid adoption all shift liquidity, price volatility, and airdrop opportunities. For NRIs, staying alert to these shifts means you can spot legitimate airdrops—like the Bull Finance or POTS token drops—and avoid scams that prey on cross‑border users. Our collection below covers everything from deep‑dive tax guides and exchange reviews to the latest airdrop alerts and regulatory snapshots. Dive in to find actionable tips, real‑world examples, and the tools you need to trade confidently as a non‑resident Indian crypto participant.

Learn how India taxes cryptocurrency for NRIs, including the flat 30% rate, lack of exemptions, residency rule impacts, and practical compliance steps.

Categories

Archives

Recent-posts

Different Variations of Proof of Stake Explained: How Ethereum, Cardano, and Others Validate Blocks

Jan, 4 2026

Finance

Finance