Buying, selling, or just holding a digital collectible feels exciting-but the moment you click "sign" you’re also opening a door to potential hacks, phishing scams, and contract bugs. The good news? You can lock that door with a handful of proven steps that keep your assets safe without turning the whole process into a labyrinth.

Why NFT security matters now more than ever

In 2024, fraud attempts on NFT platforms jumped 45% year‑over‑year, according to Check Point Research. With the market swelling to over $14billion in 2025, every transaction carries a larger financial stake and a bigger target for attackers. Unlike credit‑card purchases, blockchain trades lack chargebacks, meaning a single missed warning can erase weeks of work in seconds.

Experts agree that the most common loss vectors are:

- Compromised private keys (especially in browser extensions)

- Unverified smart contracts that drain tokens silently

- Stale token approvals that let malicious contracts act on your behalf

- Social‑engineering tricks-fake Discord DMs, deepfake project leaders, urgent‑airdrop scams

Addressing each of these risks is the core of NFT Marketplace Security a layered defense strategy that spans wallets, platforms, smart contracts, and user habits.

Step 1: Choose the right wallet and lock it down

Wallets sit at the front line. A hardware device isolates your private key from the internet, shaving the theft probability from roughly 18% for hot wallets down to 0.02% for properly used hardware wallets (Ledger internal data, 2025).

Here’s a quick comparison:

| Feature | Ledger Nano X | MetaMask (browser) |

|---|---|---|

| Private‑key storage | Offline, encrypted chip | Browser extension, exposed to scripts |

| Firmware updates (2025) | v2.3.0 (Mar15) | v11.19.1 (May3) |

| Mandatory password length | 20+ characters, special chars | Optional |

| Biometric auth | Yes (fingerprint) | No |

| Attack surface reduction | ~98% | Baseline |

If you hold more than $5,000 worth of NFTs, John Wu of Ledger recommends making a hardware wallet mandatory. The setup cost-$120 for a Nano X plus a metal seed‑phrase backup ($25‑$100)-pays off quickly when you avoid a $10k loss.

For hot‑wallet users, harden MetaMask by:

- Setting a 20‑character password with symbols.

- Enabling biometric auth on your phone.

- Turning on the built‑in transaction simulation feature.

- Never reusing the same password across crypto services.

Step 2: Vet the marketplace itself

Not every platform treats security the same way. OpenSea’s version2.5 introduced mandatory EIP‑712 typed data signing, which prevents signature spoofing by requiring a structured data payload. Rarible’s v4.2 added a 3‑of‑5 multi‑sig treasury model for any platform‑level changes.

When you sign up, check for these red flags:

- Does the site use WPA3‑encrypted connections?

- Is there a built‑in Transaction Guard (OpenSea’s May2025 rollout) that flags high‑risk operations?

- Does the marketplace require KYC? Platforms like Foundation saw an 82% drop in scam listings after making identity checks mandatory.

- Is the collection you’re buying verified? Verified listings on OpenSea have 94% fewer counterfeit items.

Even with these safeguards, you remain responsible for the final click. The “Five‑Minute Rule” from Check Point-verify a transaction through three independent sources-cut phishing losses by 63% in a 2025 user survey.

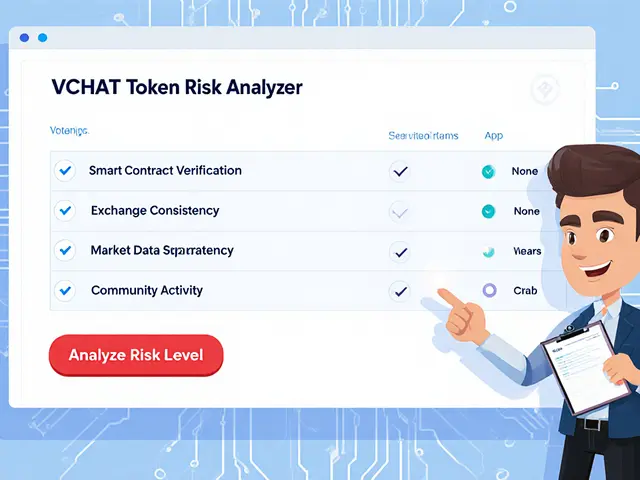

Step 3: Confirm smart‑contract audits and verification

Smart contracts are the code that moves your NFT. A 2025 Etherscan report showed 78% of fraudulent projects deployed contracts without verification, while 92% of legitimate drops were audited by firms like OpenZeppelin a leading security audit company for blockchain code.

Before you buy:

- Open the contract page on Etherscan.

- Look for the “Verified Contract” badge.

- Check the audit report link-most reputable audits are public PDF files.

- Confirm the audit date is within the last 12 months; older audits may miss recent vulnerabilities.

If a project skips this step, treat it like a mystery box with a broken lock-skip it.

Step 4: Clean up token approvals regularly

Every time you approve a contract to spend your NFT, you leave a permission that can be abused later. On average, users have about 14.3 active approvals they don’t recognize, according to Numen Cyber’s March2025 study.

The easiest way to audit is with Etherscan Token Approval Checker a free tool that lists all contracts your address has permitted. Here’s a quick routine:

- Visit the checker once a month.

- Revoke any approval that isn’t tied to a current collection you own.

- For high‑value NFTs, set a limit (e.g., 1 token) instead of “unlimited”.

In practice, a Reddit user saved an $18k CryptoPunk by revoking 27 stale approvals during the May2025 phishing wave.

Step 5: Deploy ongoing monitoring and education

Security isn’t a set‑and‑forget task. Join communities like the NFT Security Discord a server with 14k+ members sharing real‑time scam alerts. Set up alerts for:

- New contract deployments for collections you follow.

- Domain changes that could indicate phishing sites.

- Deepfake voice alerts-if a project leader suddenly “calls” you, verify via their official Twitter or Discord.

Platforms are also adding AI‑driven analysis. Gartner predicts that by 2027, 75% of NFT sites will use AI to flag suspicious behavior, cutting successful scams by 60%.

Step 6: Follow a security checklist before each transaction

Carnegie Mellon’s Blockchain Security Lab released a checklist that reduced attack success by 89% when users followed it fully. Use this condensed version:

- Confirm you’re on the official URL (check HTTPS and compare against two trusted sources).

- Verify the collection’s badge and audit status.

- Simulate the transaction (MetaMask’s preview mode) and read every function call.

- Apply the “Five‑Minute Rule”-wait at least 5 minutes and double‑check via a second device.

- Check token approvals after the trade and revoke any new unlimited allowances.

- Log the transaction ID in a personal spreadsheet for future reference.

Completing this checklist takes about 10‑15 minutes for a first‑time user, but the time saved by avoiding a loss is priceless.

Future‑proofing: what’s coming next?

The SecureNFT Standard2.0, slated for Q32025, will make dynamic permissioning mandatory and embed a short educational video for every new user. Expect platforms to roll out required “security onboarding” flows, similar to how banks now push security tutorials during account creation.

Deepfake verification attacks are already on the rise-Check Point recorded $473k in losses from AI‑generated project leader videos in April2025. Keep an eye on visual‑authentication tools that compare voice and facial patterns to verified media archives.

In short, the best defense is a habit of verification, a layered wallet strategy, and staying plugged into community alerts. Keep these practices in your routine, and you’ll stay ahead of the most common threats.

Frequently Asked Questions

Do I need a hardware wallet if I only trade low‑value NFTs?

For trades under $1,000, a hardened hot wallet with strong passwords and 2FA can be sufficient, but the moment your holdings exceed $5,000, a hardware wallet becomes the safest choice.

How often should I check my token approvals?

A monthly review catches most stale permissions. Power users who trade daily may want to do it weekly.

What is EIP‑712 and why does it matter?

EIP‑712 defines a standard for typed data signatures, making the data you sign human‑readable and preventing attackers from swapping the details behind the scenes.

Can AI‑based transaction guards generate false positives?

Yes, early versions blocked a small percentage of legitimate trades, but platforms are tuning the models to keep false positives under 2% while still catching over 60% of scams.

Is KYC a privacy risk for NFT creators?

KYC does expose personal data, but reputable platforms encrypt it and limit access. The trade‑off is a dramatically lower chance of your collection being listed as a scam.

Finance

Finance

Jessica Cadis

October 16, 2025 AT 08:38Stop treating wallet security like an afterthought. A hardware wallet isn’t a luxury, it’s a necessity the moment you own anything beyond a few dollars. Forgetting to set a 20‑character password on MetaMask is basically handing hackers your private key on a silver platter. Harden your device, lock your seed phrase in metal, and you’ll cut your risk by orders of magnitude.

Katharine Sipio

October 16, 2025 AT 08:56In addition to the hardware recommendations, users should adopt a disciplined daily routine. Verify every contract on Etherscan before signing and keep your firmware up to date. Use biometric authentication where available and never reuse passwords across platforms. These practices, while simple, form a robust first line of defense.

Shikhar Shukla

October 16, 2025 AT 09:13It is evident that many traders neglect fundamental security hygiene, thereby exposing themselves to preventable loss. The data underscores that a failure to audit smart contracts directly correlates with increased exploit incidence. Consequently, a strict verification protocol should be institutionalized for all transactions. Neglecting this step can be construed as imprudent and professionally irresponsible.

Deepak Kumar

October 16, 2025 AT 09:30Hey folks, just wanted to add that regular token‑approval clean‑ups can save you big bucks. I use the Etherscan checker every two weeks and revoke anything I don’t recognize-no hassle, no drama. Pair that with a hardware wallet and you’ve got a solid shield against the most common scams. Stay sharp and keep the community updated on new threats!

Matthew Theuma

October 16, 2025 AT 09:46lol this guide is 🔥 but remember to backup that seed phrase 🙈 #crypto

Carolyn Pritchett

October 16, 2025 AT 10:03This article is just hype. Everyone knows the “hardware wallet” mantra is overblown, yet they keep pushing it like it’s the only solution. Real attackers will find a way around any device, so the focus should be on better UI warnings, not just buying expensive hardware.

Jason Zila

October 16, 2025 AT 10:20The checklist approach is solid, but it could go deeper. Include a step to verify the TLS certificate of the marketplace and check for DDoS protection status. Also, logging transaction IDs in a spreadsheet can help trace anomalies later.

Cecilia Cecilia

October 16, 2025 AT 10:36Use the token‑approval checker monthly to stay safe.

lida norman

October 16, 2025 AT 10:53😅 I totally get the overwhelm-just think of the checker as a quick health check for your wallet. A few clicks each month can stop a rogue contract from draining your NFTs. Imagine the relief when you know no hidden permissions are lurking, especially after a phishing wave hits.

Miguel Terán

October 16, 2025 AT 11:10Security in the NFT space is evolving faster than most people realize, and staying ahead requires more than ticking boxes. First, understand that the attack surface begins the moment you install a browser extension; malicious scripts can intercept signature requests without you noticing. Second, the rise of AI‑generated deepfakes means verbal confirmations are no longer reliable, so always cross‑reference any “urgent” request with official channels. Third, the hardware wallet market has matured-devices now include secure elements that isolate the seed phrase even from compromised computers. Fourth, always verify that the marketplace’s TLS certificate is issued by a reputable authority and that the domain matches official documentation; spoofed domains can be indistinguishable at a glance. Fifth, enable transaction simulation features wherever available; they let you see the exact function calls before you sign. Sixth, keep your firmware updated-vendors frequently patch vulnerabilities that could be exploited remotely. Seventh, consider using a multi‑sig wallet for high‑value assets, which adds another approval layer that attackers must breach. Eighth, regularly audit token approvals through tools like the Etherscan checker, revoking any stale permissions that could be abused later. Ninth, maintain a personal ledger of transaction hashes; this audit trail is invaluable if you need to dispute a fraudulent transfer. Tenth, subscribe to community alert channels such as dedicated Discord servers that post real‑time scam warnings. Eleventh, implement the “Five‑Minute Rule” for every high‑value transaction-step away, double‑check on a separate device, then proceed. Twelfth, educate yourself about EIP‑712 and other signing standards that protect against data manipulation. Thirteenth, ensure your recovery phrase is stored offline in a fire‑proof, waterproof container; never keep it in cloud storage. Fourteenth, avoid using the same password across any crypto‑related service, as credential stuffing attacks are common. Fifteenth, when possible, use biometric authentication combined with a strong PIN to add defense in depth. Finally, stay informed about upcoming standards like SecureNFT 2.0, which will embed educational videos directly into onboarding flows, making security knowledge a prerequisite rather than an afterthought.

Shivani Chauhan

October 16, 2025 AT 11:26The emphasis on routine audits cannot be overstated. By incorporating the token‑approval checker into a monthly schedule, users mitigate the risk of unauthorized transfers. Additionally, confirming the presence of a verified contract badge on Etherscan adds another verification layer. These steps, when combined, significantly harden the overall security posture.

Deborah de Beurs

October 16, 2025 AT 11:43Exactly! And don’t forget to set allowance limits instead of granting unlimited access-this tiny tweak can stop a rogue contract dead in its tracks. It’s a simple habit that pays huge dividends.

Sara Stewart

October 16, 2025 AT 12:00From a devops perspective, integrating automated security scans into the deployment pipeline reduces human error. Tools that flag missing EIP‑712 implementations or outdated dependencies catch vulnerabilities before they reach users. This proactive approach complements user‑side best practices and creates a more resilient ecosystem.

Laura Hoch

October 16, 2025 AT 12:16That’s spot on. In addition to CI/CD scans, employing runtime monitoring can detect anomalous contract behavior post‑deployment, providing real‑time alerts to both the platform and end‑users. This layered defense strategy aligns perfectly with the checklist outlined in the article.

Devi Jaga

October 16, 2025 AT 12:33Oh great, another checklist-because we all have endless time to read manuals before buying art.

Hailey M.

October 16, 2025 AT 12:50😂 Yeah, but skipping the steps is like walking into a museum and trusting a painting not to bite you. A quick double‑check saves you from a pricey regret.

Schuyler Whetstone

October 16, 2025 AT 13:06Real security is more than just buying a fancy hardware wallet, its about keeping your mind sharp.

David Moss

October 16, 2025 AT 13:23Indeed, the human factor is often the weakest link. Phishing campaigns exploit trust, so verifying URLs and using two‑factor authentication are essential safeguards.

Pierce O'Donnell

October 16, 2025 AT 13:40Monthly checks, done.

Vinoth Raja

October 16, 2025 AT 13:56In practice, a quick scan of approvals each week keeps the attack surface tiny, especially for traders who flip NFTs daily.

Kaitlyn Zimmerman

October 16, 2025 AT 14:13For newcomers, the community Discords are a goldmine-members share real‑time alerts, audit links, and even step‑by‑step guides for revoking approvals. Engaging there not only educates but also builds a support network that can flag scams before they spread.

DeAnna Brown

October 16, 2025 AT 14:30Totally agree! And let’s not forget that early adopters should champion these security habits; it’s the only way we can keep the market trustworthy and avoid the “wild west” narrative.

Chris Morano

October 16, 2025 AT 14:46Staying optimistic, I believe that as more platforms adopt AI‑driven guards, the overall threat landscape will shrink, giving creators and collectors alike a safer environment to innovate.

Ikenna Okonkwo

October 16, 2025 AT 15:03Exactly, the balance between automation and user education will define the next wave of NFT security-smart tools coupled with informed users create a resilient ecosystem.

Bobby Lind

October 16, 2025 AT 15:20Great guide-thanks for the thorough rundown!!!